To repeat facts quoted in: “The rich-poor gap in America is obscene. So let’s fix it – here’s how“: Do we want a democracy or not?

- The top 1% now own more wealth than the bottom 92%.

- The 50 wealthiest Americans own more wealth than the bottom half of American society – 165 million people.

- Over the past [pandemic] year 650 billionaires have seen their wealth increase by $1.3tn.

- In 1978, the top 0.1% owned about 7% of the nation’s wealth. In 2019 … they owned nearly 20%.

- The two richest people in America, Jeff Bezos and Elon Musk, now own more wealth than the bottom 40% of Americans combined.

- If income inequality had not skyrocketed over the past four decades and had simply stayed static, the average worker in America would be earning $42,000 more in income each year.

- Instead, as corporate chief executives now make over 300 times more than their average employees, the average American worker now earns $32 a week less than he or she did 48 years ago – after adjusting for inflation.

Bernie Sanders says it again: “Today, half of our people are living paycheck to paycheck, 500,000 of the very poorest among us are homeless, millions are worried about evictions, 92 million are uninsured or underinsured, and families all across the country are worried about how they are going to feed their kids. Today, an entire generation of young people carry an outrageous level of student debt and face the reality that their standard of living will be lower than their parents’. And, most obscenely, low-income Americans now have a life expectancy that is about 15 years lower than the wealthy. Poverty in America has become a death sentence.“

“A job should lift workers out of poverty, not keep them in it.” So raise the minimum wage with the object of righting the inequality by recycling the money that went to the top when it should not.

Can’t be done without restored and reinvigorated union power.

“We need to create millions of good-paying jobs rebuilding our crumbling infrastructure – our roads, bridges, wastewater plants, sewers, culverts, dams, schools and affordable housing.

“We need to combat climate change by fundamentally transforming our energy system away from fossil fuels towards energy efficiency and renewable energy which will also create millions of good paying jobs.

“We need to do what virtually every other major country does by guaranteeing healthcare to all people as a human right. Passing a Medicare for All program would end the absurdity of us paying twice as much per capita for healthcare as do the people of other countries, while tens of millions of Americans are uninsured or under-insured.

“We need to make certain that all of our young people, regardless of income, have the right to high quality education – including college. And that means making public colleges and universities tuition free and substantially reducing student debt for working families.

“And yes. We need to make the wealthiest people and most profitable corporations in America start paying their fair share of taxes.

“Growing income and wealth inequality is not just an economic issue. It touches the very foundation of American democracy. If the very rich become much richer while millions of working people see their standard of living continue to decline, faith in government and our democratic institutions will wither and support for authoritarianism will increase. We cannot let that happen.”

Wealth recycled to the people with nature’s asymmetric sense of justice for all: A movement that people with money should intuitively be able to endorse. If they cannot, then clearly their money distorts their vision of the economy. Let’s stand up and clarify the situation for all. Or fool me again!

The sutras “act like firecrackers in your intellectual reading consciousness.” -Dana Wilde, Morning Sentinel, Kennebec Journal, author of Nebulae: A Backyard Cosmography and The Other End of the Driveway

All the evidence of experimental science reveals that nature is asymmetric. No pure symmetry has ever been found, although it is often assumed. What does it mean to live in an asymmetric environment? A breakthrough logic of asymmetric change shows how nature has a democratic, panpsychist, moral compass that invites a yogic understanding of the way the economy should live and breathe with the planet.

A book of environmental and climate justice with the discovery of nature’s fundamental moral compass through a new panpsychism.

Yoganomics unfolds an innovative solution to the famous “hard problem” of the relationship between nature and consciousness, mind and body, and the naturalistic fallacies, step by step, in the style of the ancient sutra for deductive clarity. The Transformation Proof and its corollary, the Asymmetric Pressure Principle, are presented with a new logic of asymmetric equilibrium change. The body of the economy needs to breathe in a healthy, rhythmic polarity. A comparison would be with nature’s asymmetric pressures that allow sailing, surfing, flying, skiing, windmills. Congestive monocultures of absolutism must be liberated with the understanding that nature is fundamentally inclusive, as the River of Asymmetry runs through it. In color inside and out (depending on e-reader device), with 28 illustrations.

Happy hopeful Pi Day! Remember October? Anyway, Pi has snagged me again with the reminder that the year is kinda round (not perfectly round, mind you) but round enough to grow a pumpkin for a pie for today, and to say, once more, Happy Pi Day to all! And this post will stay a while, until I am snagged in here again. Meanwhile, let’s shake this pandemic once and for all and stay prepared, please. We could do with a slice of something better about now, or should I say, a shot in the arm? Pi is also math’s hidden language of puns. For without double and multiple meanings there would be no numbers. Seriously, you didn’t think I’d let you off the hook without snagging a reference to one of my books, did you? It’s “The Imperfect Democratic Tao of Pi.” As for getting sucked in, click here or above, the article on the “snags of Pi” is imperfectly the same. 2 much of a good thing, like pretending all those decimals just go on forever…

Saturn’s ocean moon, Enceladus: Enough heat to power interior hydrothermal activity for billions of years, generated through tidal friction, if the moon has a highly porous core, a new study finds.” The moon is a potentially habitable world.

“This includes a global salty ocean below an ice shell… Jets of water vapour and icy grains are launched through fissures in the ice. The composition of the ejected material measured by Cassini included salts and silica dust, suggesting they form through hot water – at least 90ºC – interacting with rock in the porous core.

“The efficient rock–water interactions in a porous core massaged by tidal friction could generate up to 30 GW of heat,” for tens of millions to billions of years.

“‘Future missions capable of analysing the organic molecules in the Enceladus plume with a higher accuracy than Cassini would be able to tell us if sustained hydrothermal conditions could have allowed life to emerge,’ says Nicolas Altobelli, ESA’s Cassini project scientist…

“’We’ll be flying next-generation instruments … to Jupiter’s ocean moons [Ganymede, Callisto and Europa] … with ESA’s Juice mission, which is specifically tasked with trying to understand the potential habitability of ocean worlds in the outer Solar System,’ adds Nicolas.”

Source: Heating ocean moon Enceladus for billions of years

JUICE – JUpiter ICy moons Explorer – is the first large-class mission in ESA’s Cosmic Vision 2015-2025 programme. Planned for launch in 2022 and arrival at Jupiter in 2029, it will spend at least three years making detailed observations of the giant gaseous planet Jupiter and three of its largest moons, Ganymede, Callisto and Europa.

Callisto

Europa

Ganymede

How and why the absence of absolute symmetry in nature allows for the multifarious creation of worlds is explained with the logic of asymmetry developed in Unicycle, the Book of Fictitious Symmetry and Non-Random Truth.

Into the solstice once more!

Pi is the relationship between a circle and it’s diameter. Sounds simple. But it’s not really a simple fact that the diameter fits into the circumference 3.14 times — that will not quite do it, will it! — There’s a snag. All those decimals in a tangle: 3.141592653… and on and on and on, and will they ever let go! Murphy’s law of land and sea advises us that if something can snag, it will snag. A rope round a protrusion, even in calm weather, an electric lawnmower cord on a smooth rock, we have our favorites.

Something obtuse about natural law seems to invite things to snag on things. And so I will venture the thought that, in spite of the trouble, it might be a good thing. Without this unruly attraction, what could connect? Not that everything that connects need be called a “snag,” but the point is that the snag was not the destination. We had someplace in mind, some objective that was presumed more snag-less.

The surprising thing about pi is that we are alerted against thinking the circle is perfect, that it will come clean. The decimals of pi are a string of red warning lights. Endlessly imperfect! That the circle will not close absolutely is re-enumerated in all sorts of ways, no matter how we pull on it — but it does get our attention. It’s got traction.

In the absence of perfection, the circle connects with things; it snags many things in the real world and in the imagination. But it can be unsnagged if we find where it connects, so we can stop pulling on more decimals, stop counting pi and be aware of something else. How many decimals must we endure before we cave and admit that there are no absolutely perfectly symmetrical circles, no absolutes at all, in fact, in the absence of any perfectly straight lines for diameters? Pi calls out echoingly that infinity is a snag, mathematically as well as otherwise. It is snagging the loftiest physicists. Where the rubber meets the road, pi provides useful traction when viewed realistically. Experimental science has not found any pure symmetry in nature, at all. Walk outside and find me just one thing that does not imperfectly imply circularity.

Just when you think you can identify symmetry in a flower, in a leaf, there is a snag, one of the petals is askew, and that is a beautiful thing — nature’s true balance. Another beautiful aspect of pi is its call to democracy. We can share the democratic pi in a balanced way by getting inspired by nature’s gifts. How does the circle snag democracy? The number pi snags the mind into the natural world, in spite of our presumptions and with no need to be familiar with the snagger. Individuals are brought together, not into a monoculture of symmetrical banality, but into a potential flourishing of character, one and all.

This notion of a dancing, changing, balancing polarity in circles is of course not new, and is renewable in time. The ancient understanding of the polarities of the Tao have long been applied to relationships of a circle, where Yin and Yang move round each other. So do not be snagged by an illusion of some ideal symmetry in the famous Yin-Yang symbol! As the I Ching, the Book of Changes, foretells in the natural cycles of the lines of its well-weathered hexagrams, absolutes are overturned, preemptively snagged, I would add. The connections between the seasons and the livelihood of the people had deep and long-recognized roots in the planet, way before it was widely known to be round.

The vital questions of how to live and behave as humans among the forces of nature, what is right and wrong and what works and what fails in life; these issues have long focused the mind as it developed. Does nature have a moral compass? Should we follow it? If so, how? But these questions have begun to look dated, and we have become jaded. We need to be snagged by more democratic pi all round! Yoganomics opens up opportunities for further exploration, puns included.

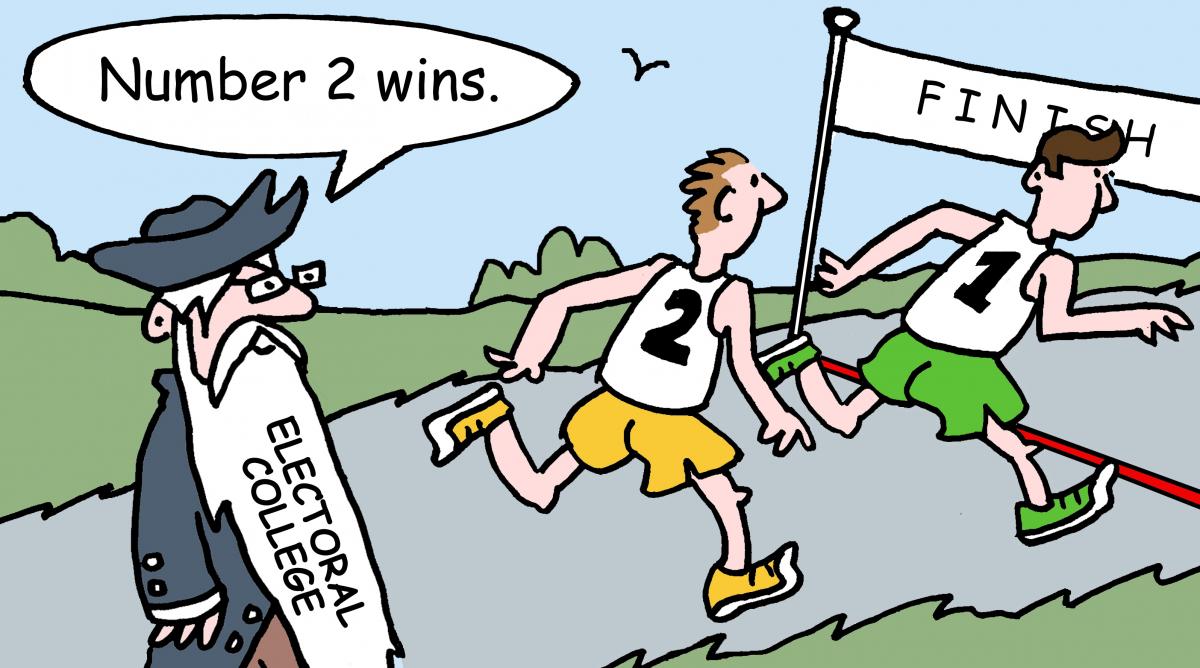

5 of 45 Presidents Came into Office Without Getting the Most Votes Nationwide: John Q. Adams (1824), Rutherford B. Hayes (1876), Benjamin Harrison (1888), George W. Bush (2000), Donald Trump (2016). Alternative history, anyone? Check out the chart. Will we wonder, What if we had not lost so much in the Middle East? What if we still had a democracy?

In 2016, Donald Trump became President even though Hillary Clinton won the national popular vote by 2,868,518 votes. Trump won because he carried Michigan by 11,000 votes, Wisconsin by 23,000 votes, and Pennsylvania by 44,000 votes. Each of these 78,000 votes was 36 times more important than the 2,868,518 votes cast in other states.

In 2000, George W. Bush became President even though Al Gore won the national popular vote by 537,179 votes. Bush won because he carried Florida by 537 votes. Each of these 537 votes was 1,000 times more important than the 537,179 votes cast in other states. More…

The National Popular Vote bill would guarantee the Presidency to the candidate who receives the most popular votes across all 50 states and the District of Columbia. Explanation. It has been enacted into law in 16 jurisdictions with 196 electoral votes (CA, CO, CT, DC, DE, HI, IL, MA, MD, NJ, NM, NY, OR, RI, VT, WA). The bill will go into effect when enacted by states with an additional 74 electoral votes. See map.

“Last week, Nate Silver, the polling analyst, tweeted a chart illustrating the chances that Joe Biden would become president if he wins the most votes in November.

“Last week, Nate Silver, the polling analyst, tweeted a chart illustrating the chances that Joe Biden would become president if he wins the most votes in November.

“Mr. Silver’s analysis is bracing. If Mr. Biden wins by five percentage points or more — if he beats Donald Trump by more than seven million votes — he’s a virtual shoo-in. If he wins 4.5 million more votes than the president? He’s still got a three-in-four chance to be president.

“Anything less, however, and Mr. Biden’s odds drop like a rock. A mere three million-vote Biden victory? A second Trump term suddenly becomes more likely than not. If Mr. Biden’s margin drops to 1.5 million — about the populations of Rhode Island and Wyoming combined — forget about it. The chance of a Biden presidency in that scenario is less than one in 10.” —By Jesse Wegman, NYT, Read the article: The Electoral College Will Destroy America.

From two articles, contrasting Camus and Sartre, Decartes and Shakespeare:

1. “How Camus and Sartre Split up Over the Question of How to Be Free”

Their radically opposed ideas of freedom broke up the philosophical friendship of the 20th century. By Sam Dresser, editor of Aeon

As Europe was rebuilding after WWII, “They were gleaming icons of the era. Newspapers reported on their daily movements: Sartre holed up at Les Deux Magots, Camus the peripatetic of Paris… Readers looked to Sartre and Camus to articulate what that new world might look like. ‘We were,’ remembered the fellow philosopher Simone de Beauvoir, ‘to provide the postwar era with its ideology.'”

The existentialism of “Sartre, Camus and their intellectual companions rejected religion, staged new and unnerving plays, challenged readers to live authentically…” As Sam Dresser writes, “We must choose to live in this world and to project our own meaning and value onto it in order to make sense of it. This means that people are free and burdened by it, since with freedom there is a terrible, even debilitating, responsibility to live and act authentically… If the idea of freedom bound Camus and Sartre philosophically, then the fight for justice united them politically.”

Albert Camus: “Absolute freedom is the right of the strongest to dominate… Absolute justice is achieved by the suppression of all contradiction: therefore it destroys freedom.” In Dresser’s words, “The conflict between justice and freedom required constant re-balancing, political moderation, an acceptance and celebration of that which limits the most: our humanity. “‘To live and let live’ [said Camus] ‘in order to create what we are.’ Sartre read The Rebel with disgust. As far as he was concerned, it was possible to achieve perfect justice and freedom.” This absolutism threw Jean-Paul Sartre and many others down the addictive rabbit hole, the impossible symmetries of communism (plus of course, Tweedledum and Tweedledee).

Dresser continues, “With the publication of The Rebel, Camus declared for a peaceful socialism that would not resort to revolutionary violence… Sartre, meanwhile, would fight for communism, and he was prepared to endorse violence to do so. The split between the two friends was a media sensation.”

Dresser concludes: “Absolutism, and the impossible idealism it inspires, is a dangerous path forward – and the reason Europe lay in ashes, as Camus and Sartre struggled to envision a fairer and freer world.” Read the relevant and succinct article here…

2. “Much Ado About Uncertainty: How Shakespeare Navigates Doubt.” By Lorenzo Zucca, author of the work-in-progress, The Poet of Uncertainty: How Shakespeare Helps us Navigate an Uncertain World.

I am spoiled for choice of quotes in this article, but Zucca begins by summing things up with a familiar and relevant theme:

William Shakespeare lived in an age of uncertainty. His society was traversing a number of unpredictable challenges that spun from the succession of the heirless queen Elizabeth to the ascent of a new class of merchants. But the biggest issue had to do with religious conflicts. In the premodern world, religion provided absolute certainty: whatever we knew was implanted in our mind by God. We didn’t have to look any further. Once that system of beliefs started to collapse, Europe was left with a yawning gap. Religion no longer seemed capable to explain the world. René Descartes and Shakespeare, who were contemporaries, gave opposite answers to the sceptical challenge: Descartes believed that our quest for knowledge could be rebuilt and founded on indubitable certainties. Shakespeare, on the other hand, made uncertainty a leitmotiv of all his works, and harnessed its creative power.

Zucca brings vitality to these matters by spotlighting some plays, revealing such things as ethics and factual analysis like we rarely see them. Because I am tired of hearing reverence for Plato, I like this:

Poets have long been denied the right of residence in the republic of philosophers. The main charge against poets is that their art is not likely to educate the masses to be good. Plato castigates poetry and claims it should be expunged of images that command excessive emotions: gods cannot be portrayed as moody or weak or as having too much pleasure; that would send the wrong message to the people. Heroes should not be shown as doing monstrous deeds; they would no longer be seen as models. More generally, poets have a tragic worldview that captures psychological conflicts within someone’s soul, but don’t advance recommendations as to how to deal with them.

Plato made an icon of Socrates, whose famous suicidal encounter with democracy lives in memory today. But how long would Shakespeare have lasted in Plato’s Republic? We only need to wonder what kind of death that would have been.

One more, involving the rebel poet John Keats:

Shakespeare’s vision from uncertainty brings together the imagination of a poet, the judgment of a philosopher, and the creativity of a scientist. Being capable to stare into the abyss without being swiped away emotionally is a great attitude for whoever wishes to further our understanding of the world and the way we live in it. The poet John Keats described it in 1817 as the negative capability: ‘when a man is capable of being in uncertainties, mysteries, doubts, without any irritable reaching after fact and reason’. By refusing to colour the world with his own rose-tinted spectacles, Shakespeare allows greater room for systematic understanding. He has an intuitive grasp of human limitations of knowledge, and to this extent he painstakingly alerts us to the biases and prejudices in our judgment.

As Zucca says, “Uncertainty makes freedom and creativity possible.” Read the long and the short of it here at Psyche…

Some key Krugman quotes:

He begins with this quote from B. Traven’s 1927 novel, The Treasure of the Sierra Madre: “Anyone who is willing to work and is serious about it will certainly find a job. Only you must not go to the man who tells you this, for he has no job to offer and doesn’t know anyone who knows of a vacancy. This is exactly the reason he gives you such generous advice, out of brotherly love, and to demonstrate how little he knows the world.”

Krugman: “It turns out [Traven] knew more about economics than any member of the modern G.O.P. caucus — a group whose members believe that cutting unemployment benefits and thus forcing people to seek jobs at all cost will somehow conjure more jobs into existence.”

“Today’s column was about the failure of Senate Republicans and the Trump administration to come up with any meaningful plan to deal with the expiration of special pandemic aid to the unemployed. Much recent economic research has investigated how much effect this aid had on incentives of workers to seek jobs, with the apparent answer being not much. As I argued, however, this question is largely irrelevant: no matter how hard workers look, they can’t take jobs that aren’t there.” More…

And from “Today’s column,” Aug. 3, 2020:

The Unemployed Stare Into the Abyss. Republicans Look Away.

The cruelty and ignorance of Trump and his allies are creating another gratuitous disaster.

“In case you haven’t noticed, the coronavirus is still very much with us. Around a thousand Americans are dying from Covid-19 each day, 10 times the rate in the European Union. Thanks to our failure to control the pandemic, we’re still suffering from Great Depression levels of unemployment; a brief recovery driven by premature attempts to resume business as usual appears to have petered out as states pause or reverse their opening.

“Yet enhanced unemployment benefits, a crucial lifeline for tens of millions of Americans, have expired. And negotiations over how — or even whether — to restore aid appear to be stalled.

“You sometimes see headlines describing this crisis as a result of “congressional dysfunction.” Such headlines reveal a severe case of bothsidesism — the almost pathological aversion [addiction to symmetry!] of some in the media to placing blame where it belongs.

“For House Democrats passed a bill specifically designed to deal with this mess two and a half months ago…

“Republicans, however, have shown no sign of understanding any of this. The policy proposals being floated by White House aides and advisers are almost surreal in their disconnect from reality. Cutting payroll taxes on workers who can’t work? Letting businesspeople deduct the full cost of three-martini lunches they can’t eat? …

“Above all, Republicans seem obsessed with the idea that unemployment benefits are making workers lazy and unwilling to accept jobs.

“This would be a bizarre claim even if unemployment benefits really were reducing the incentive to seek work. After all, there are more than 30 million workers receiving benefits, but only five million job openings. No matter how harshly you treat the unemployed, they can’t take jobs that don’t exist.

“It’s almost a secondary concern to note that there’s almost no evidence that unemployment benefits are, in fact, discouraging workers from taking jobs. Multiple studies find no significant incentive effect...

“So the attack on unemployment aid is rooted in deep ignorance. But there’s also a strong element of malice.” Krugman muses earlier in the op-ed, “Well, I’m of two minds. Was it ignorant malevolence, or malevolent ignorance?” Understandable question, but I would place it more in the medical category of addiction to absolutes. But Krugman has long pointed out that this malice goes back to the old fixation on the excuse of ills attributed to the perennial criminal and lower classes.

“Republicans have a long history of suggesting that the jobless are moral failures — that they’d rather sit home watching TV than work. And the Trump years have been marked by a relentless assault on programs that help the less fortunate, from Obamacare to food stamps. As Oliver twist might ask, More?…

While America Looks Away, Autocrats Crack Down on Digital News Sites

“Independent journalism is on the defensive, from Hungary to Malaysia,” by Ben Smith, July 12, 2020, NYT

“They are the little Gaulish village holding out against Rome,” marveled Naresh Fernandes, the editor and co-founder of Scroll, an Indian news site. Scroll, like the Hong Kong Free Press, represents a different strain in the current crisis for independent media — both are digital outlets in countries now rolling back their once-robust free press traditions.

More…

Maine Grains is just down the Kennebec River from us, and when I taste the flour, I’m so glad to be here. And here’s what I saw on the NYT home page:

That Flour You [We] Bought Could Be the Future of the U.S. Economy

“Keep baking bread. Small grain companies may suggest a better path for American business, by Tim Wu, NYT, July 24, 2020.”

On the Maine Grains homepage: “We believe that a gristmill is at the heart of turning the many and varied contributions of a community into sustenance for all.”

Over the years we have been involved here and there in helping out the process of finding and reviving an exciting street life in old mill towns and their regions. Another book asks to be written, but here’s Tim Wu’s article and a few excerpts:

This bigger-is-better, dominate-the-industry strategy is a major reason the American economy is as oligarchical and homogeneous as it is. It leads to large national companies that richly reward shareholders and executives while limiting workers’ salaries and reducing the prospects for smaller or local competitors. The sale of flour is no different.

Companies like Maine Grains and King Arthur are challenging the commodity pressures in flour markets using methods that were pioneered in the craft beer and local produce markets. The commodity industry takes flour as flour — just an ingredient, the cheaper the better. But baking is also an emotional experience, an act of creation in its beauty and intensity, a longstanding symbol of the home. And it provokes, in some, a yearning to connect with local soil and local land…

A regional mill like Maine Grains represents a more radical vision: the return of true agricultural localism. As Amber Lambke, the founder and chief executive of Maine Grains, told me, there’s more to that vision than selling a fancy type of flour. The local mill is the missing link in a local food economy that sees regional trade between farmers, bakeries, beer breweries and raisers of livestock.

The regional grain industry also employs more people, relative to its size…

We have, for the past few decades, put our faith in an economic model that insists that everyone will be better off if we do everything to make production as cheap as possible, keeping prices and salaries low, and make every region of the economy highly specialized. That approach, it turns out, does make some people rich, but it does not help everyone.

The flour industry might seem an unlikely arena for business innovation. There was once a time, in the 1990s and 2000s, when it was widely thought that Silicon Valley would show us the way to a better, fairer economy, creating entire ecosystems of companies with distinctive offerings. Yet that was before the emergence and eventual dominance of Amazon, Facebook and Google. Instead of high-tech, it is low-tech businesses like craft beer and community supported agriculture that seem to stand at the forefront of economic transformation.

If it can happen with flour, it can happen anywhere.

Whole loaf here…

Mr. Wu is the author of “The Curse of Bigness: Antitrust in the New Gilded Age,” and “The Attention Merchants: The Epic Scramble to Get Inside Our Heads.” Both books succinctly helped me gain perspective on a warped economy.